In recent years, private markets have accelerated their growth curve despite the stringent rules limiting investment access to accredited investors or those individuals who meet the income and asset qualifications.

An accredited investor has access to a wide network of private investment opportunities with significant upside potential. But how does one know if he or she is an accredited investor?

The Ontario Securities Commissions or the National Instrument or NI 45 106 set the descriptions of an accredited investor in Ontario and other provincial securities commissions throughout Canada. These rules created advantages to investing in large-scale investments which are the driving forces of Canada’s future economic growth.

Individual Qualifiers

There are plenty of clauses surrounding the qualification of an accredited investor.

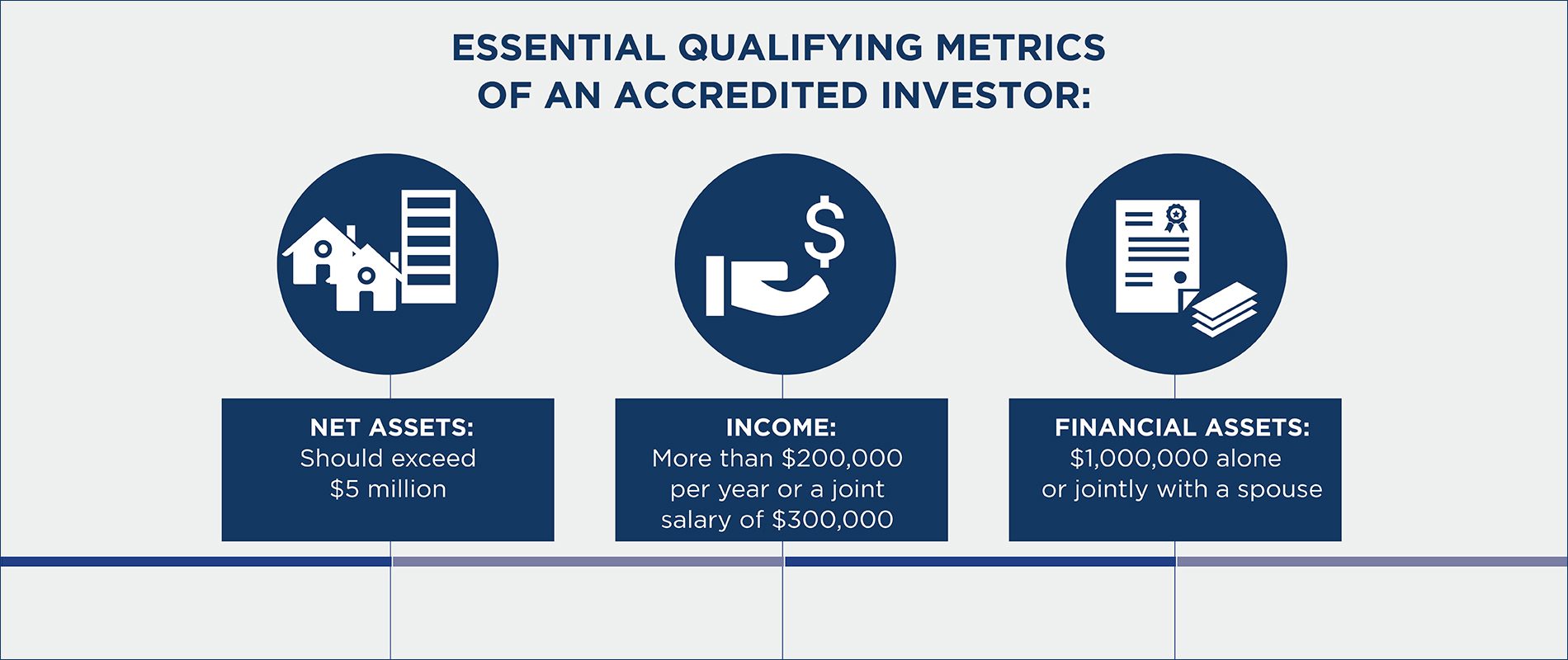

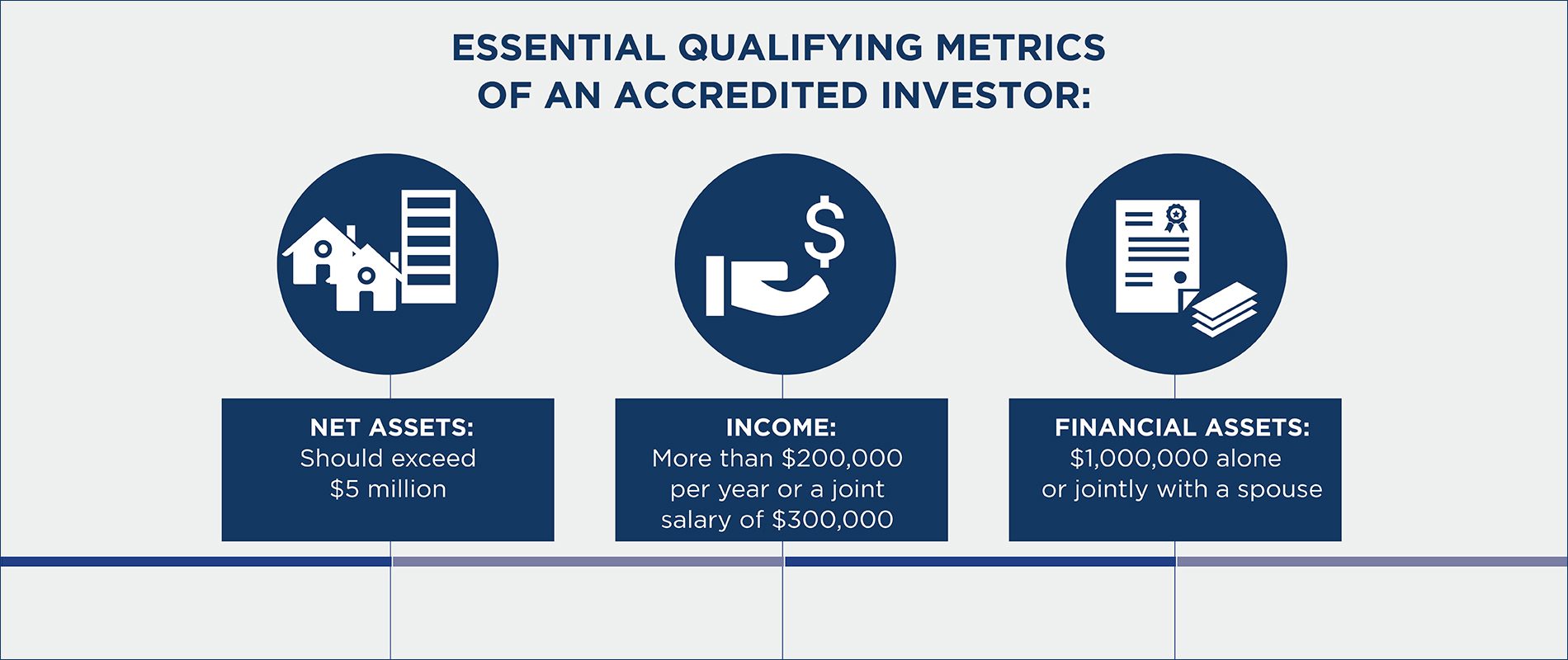

Consider these essential qualifying metrics:

Net Assets

As an individual investor, your net assets should exceed $5 million, either alone or jointly with your spouse. Remember that this figure does not include the equity in your primary residence and other liabilities.

Income

Your income must be more than $200,000 per year, or a joint salary of $300,000, in each of the past two years and expected to reasonably keep the same level of income.

Financial Assets

Your aggregate financial assets of $1,000,000 (for example: cash, stocks, bonds, etc) alone or jointly with a spouse. These assets exclude liabilities and are calculated before taxes. Any liquid investments like public equity or bonds are also considered financial assets.

Other qualifiers also show that at least you are a registered dealer other than a limited market dealer.

Some companies are able to fund sophisticated investment vehicles and are also qualified as accredited investors as long as they meet the recommended guidelines which can be any of the following:

- A pension fund that is governed by the Office of the Superintendent of Financial Institutions (Canada), a pension commission or related regulatory authority of a jurisdiction of Canada.

- A company or trust authorised to perform business by the Trust and Loan Companies Act (Canada) and or under similar legislation in a jurisdiction of Canada.

- An Investment fund that distributes securities under sections 2.10, 2.19, and 2.18 of the Prospectus and Registration Exemptions.

- An investment fund that is guided by a person listed as an adviser or a person that is exempt from registration as an adviser.

Investment opportunities for Non-Accredited Investors

Although the rules are strict and specific, the rise of the private market was highly significant due to the contribution of certain investment funds. You don’t need to be an accredited investor to grow your wealth and venture into broader opportunities.

There are a number of popular alternative investments that you can participate in with strong potential for high return including real estate mortgages. This particular investment vehicle is a small but growing opportunity in Canada.

As banks are making every effort to tighten their rules by adding mortgage stress tests and increasing rates, people are left with little other options but to look into alternative mortgage funds to support their housing needs.

Mortgage Investment Corporations

Mortgage investment corporations or MICs allow investors to pool their money and provide loans to individuals and companies that were turned down by conventional institutions including banks, credit unions, and big lending companies usually at a slightly higher rate with varying loan periods. At least 50% of its assets should be in physical real estate, most of which include high-yield, residential mortgages.

One of the most appealing elements of participating in a MIC includes the typically stable and robust dividend rate that they provide to their shareholders while providing participating shareholders with mitigated risk through diversification.

Crowdfunding

Another popular investment alternative is equity crowdfunding, as everything is done online without any real hassles. You can search for a particular investment vehicle you wish to finance as there are countless emerging and successful crowdfunding platforms specializing by industry.

You can browse for potential crowdfunding investments in British Columbia, Manitoba, Ontario, Québec, New Brunswick, Saskatchewan, and Nova Scotia; while the remaining provinces have ongoing rule negotiations with respect to crowdfunding.

Where to Start?

One element both MICs and real estate crowdfunding vehicles have in common is the underlying location of the asset. Invest in key areas where real estate is well-performing.

Not all MICs are made equal. Typically, it boils down to the performance and background of the company with the MIC offering. Consider the company and their track record before deciding on where to park your money.

Look beyond the performance indicators offered by the fund managers and also consider the wider economic fundamentals that support the future potential growth of the investments held in the fund. You could start by investigating the macroeconomics of the city itself to evaluate the potential upside.

Markets like Vancouver and Victoria may be named as the hottest housing markets in the media today but tomorrow they may be yesterday’s news with new markets frothing up. Always consider the long-term potential and not merely rely on the news outlets providing their opinions.

Risk and Reward

Regardless if you are an accredited investor or not, all investments come with risks. The more you reach for higher yields, the riskier the investment is prone to be. Consult an expert to have a reliable market understanding as well as having better options on how to expand your portfolio while mitigating investment risk.