For the past few decades in Canada, the real estate business has been booming exponentially. As a matter of fact, according to a report released by Statistics Canada, at least a fifth of Canada’s GDP in 2017 can be attributed to real estate related ventures.

More people and businesses are moving towards major cities in Canada especially Vancouver, Toronto, and Montreal. The outcome is the demand for real estate exceeding the supply, which in turn increases the rents. Moreover, most millennials can only afford to buy a home through mortgage loans.

Away from the hustle and bustle of the city, young families are looking for secondary vacation homes around ski resort destinations. This trend is responsible for the high demand for residential properties in rural areas such as Mont-Tremblant, Bromont, Muskoka, and Collingwood.

Despite the recent slowdown talks, a lot of investors are still folding their shirts up and getting ready to get a piece of the cake through mortgage investing.

But wait! It’s a jungle out there! Investing as an individual in the mortgage business is like walking into an Indiana Jones treasure hunt cave being extra careful not to step on the wrong stone before the whole chamber tumbles down.

No doubt, it is a huge risk for individuals without prior experience. However, there is always the option of putting your money in a Mortgage Investment Corporation (MIC).

If you’re reading this, you’re probably asking yourself, what is a MIC? And why should I invest in one? Let’s take a closer look at this investing strategy.

What is a MIC?

Mortgage Investment Corporations, otherwise known as MICs, have been in existence since 1973. However, it was only after the 2008 financial crisis that many Canadians turned to MICs due to banks and regulators tightening borrowing policies.

MIC entities are stipulated under section 130.1 of the Canadian Income Tax Act. The purpose of MIC is to provide a platform for individuals to create a pool of funds to invest in mortgage loans. Think of MICs like banks, but with different rules. Unlike banks, MICs deal exclusively with lending capital to Canadians who are willing to purchase, develop, or invest in real estate.

A MIC by the numbers…

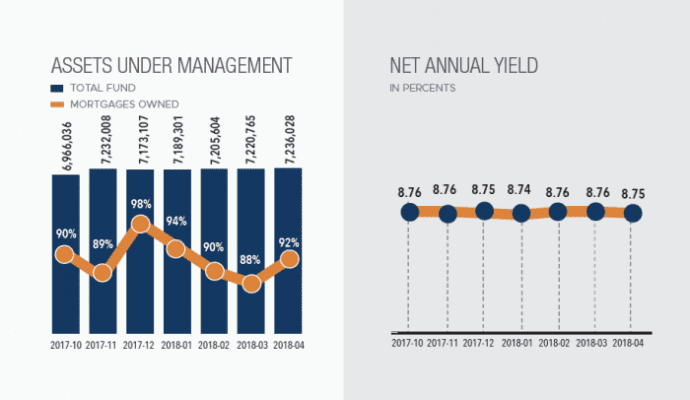

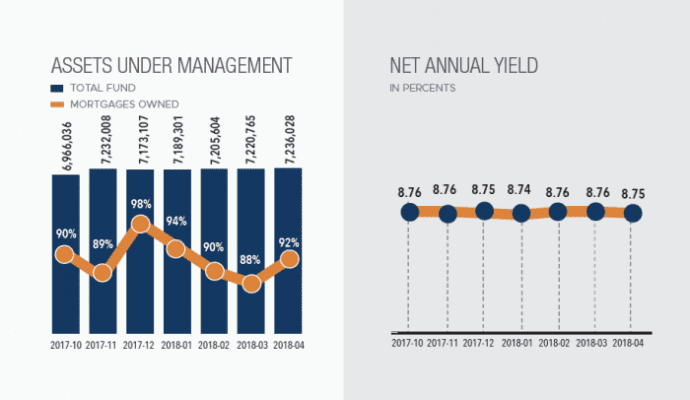

Now let’s look at a few numbers based on data from Canadian Mortgages Inc.

The above graph shows the mortgage assets that have been managed by CMI from October 2017 to April 2018. At least $7 million has been accumulated in the funds’ pool with an average return of 8.75 percent.

You can see why most investors are attracted to MICs. When was the last time you heard a high-interest savings account acquiring more than 2 percent interest?

Investment-grade corporate bonds are good, but you would be lucky to get more than 5 percent in Canada. Additionally, you can invest in index or mutual funds but the stock market indices may rise and fall drastically.

In contrast, an average annual MIC return of between 8% and 9% is extremely appealing to sophisticated investors. Particularly given the fact that your investment is backed by physical real estate assets.

Mortgage Investment Corporations understand that the real estate market is filled with inevitable fluctuations. That is why risk mitigation must be done to ensure consistent results for investors.

Based on careful market analysis, there are certain minimum thresholds in place to mitigate risk. Such countermeasures can include:

- Creating a diversified portfolio for shareholders to put their funds in a wider pool of mortgages across Canada. Usually, a diversified pool of mortgages will involve no single loan that surpasses 10% of the book value.

- The MIC puts more focus on fast-growing residential real estate markets across Canada. This includes analyzing key market areas across the country to find out which regions are stable and less likely to experience a recession. For that reason, it is common for a MIC to prioritize investment in first and second residential mortgages especially in urban areas such as Ontario where the demand exceeds supply.

- Involving a team of experts who are well-versed and experienced to evaluate equity growth projections, liquidity value of a property and the capability of applicants to repay a debt.

- In the event that shareholders want to make redemptions of their principal amount, they can access reserved cash at their disposal.

Aside from the expected returns, there are other benefits and convenience of investing in a MIC. For instance, as per the Canadian Income Tax Act, the net income that MICs earn from their diversified portfolio is not taxed.

That means 100 percent of their earnings are channelled to the shareholders through dividends.

Moreover, there are other advantages of MIC such as:

- Shares owned by individuals in MICs are considered credible and eligible for registered savings plans such as LIRA, RESP, RRIF, TFSA, and RRSP.

- Investors can redeem their shares without penalty after 2 years. However, a 90 days’ notice should be served.

- There is a regular income flow for the shareholders. As an investor, you can opt to take your dividends through cash or re-invest your shares back into the mortgage pool. Additionally, you can chip in your investment into the MIC through cash or a registered trust account.

- Every share is equal to the capital contributed by the investor in the funds’ pool (usually $1 share is equal to $1 invested).

- There are no fees for joining or leaving a MIC, unless it is prior to 24 months, in which an early redemption fee will apply. However, charges may be incurred when hiring professional opinion or management. The MIC can choose to offer shares through Waverley Corporate Financial Services or Exempt Market Dealer once the investors meet all the compliance requirements.

- Since most homeowners turn to MICs after being turned down by banks and credit unions, the interest rates are slightly higher than other alternative loan providers. Of course, an extensive background check must be done on the borrower before the mortgage loan is approved.

It is very unlikely that you will hear MICs making the news like Amazon, Facebook or any of those big time investment corporations. Quite frankly, MICs are simple and straightforward.

All investors do is put their money into the resource pool and wait for your interest in form of dividends. As long as the MIC is being managed by a team of experts, you have little to worry about.

So, what is a MIC? A MIC provides sophisticated investors with a platform to create a pool of funds that invest in mortgage loans. Simple as that.

Now that you have a much better understanding of this popular investment vehicle, feel free to view current MIC investment opportunities.