The Covid-19 pandemic caught the entire world by surprise. In most major economies like Canada, a synchronized response from all levels of government saw the central bank slash interest rates to record lows. These actions provide much needed support for the financial system and economy during these unprecedented times. With the economy on life support, rates are expected to remain suppressed for the foreseeable future. Against this backdrop, and in light of extreme portfolio volatility since the March 2020 liquidity crisis, investors are increasingly turning to alternative investments to grow and protect their wealth.

Mortgage Investment Corporations (MICs) are one of the fastest growing segments of the alternative investment landscape. This asset class is made up of individual investors who pool their money to lend out to borrowers in the form of private mortgages.

The rationale behind a MIC is that banks and other traditional financial institutions do not lend money to the entire addressable market for mortgages. There are always borrowers who, for various reasons, do not qualify for a traditional mortgage or simply prefer not to borrow from a traditional bank. Stricter lending requirements, new government controls and rising home values have all contributed to the growth of private mortgages.

From the perspective of borrowers, private mortgages usually offer more flexible terms and conditions than going through a traditional bank. In exchange for less stringent lending requirements, borrowers pay a higher interest rate.

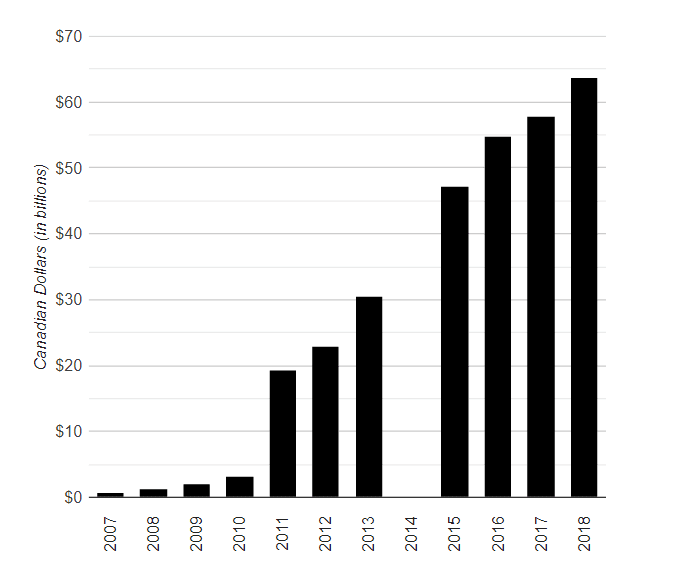

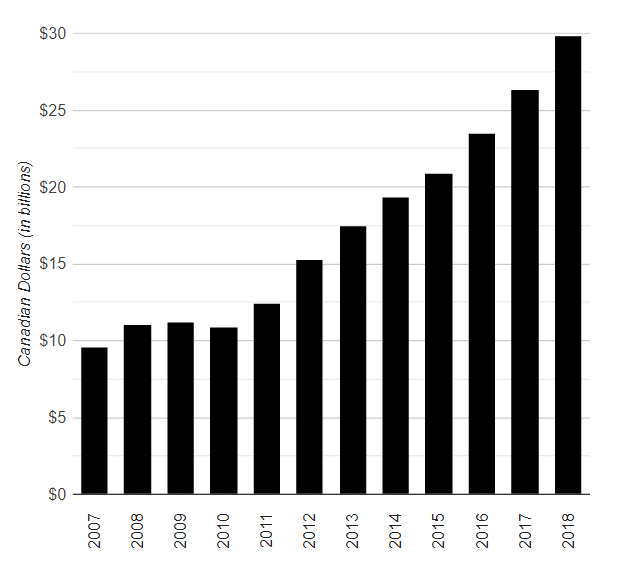

The total value of all non-bank mortgage loans in Canada surged 924.2% between January 2007 and December 2018, according to data from Statistics Canada. The nation’s non-bank mortgage industry, which includes mortgage investment corporations, tripled their business over the 11-year study. Assets held in mortgage investment corporations surged to nearly $30 billion in 2018, up 13.3% from a year earlier and 211.2% from 2007.

In other words, more Canadians are turning away from big banks, credit unions and other traditional lenders to finance their mortgage needs.

Caption: Canadian mortgage finance companies (MFCs) held $63.7 billion in assets at the end of 2018—up 7,606% over 11 years. MFCs originate, package and sell mortgages to financial institutions. According to Statistics Canada, 2014 data are suppressed to meet confidentiality requirements. | Source: betterdwelling.com

Caption: Assets held in mortgage investment corporations have grown steadily since the 2008 financial crisis as demand for non-bank intermediaries rose. | Source: betterdwelling.com

How MICs Operate

A Mortgage Investment Corporation is an investment fund that pools capital from several investors to fund private mortgages. It operates very much like a mutual fund or exchange-traded-fund, but instead of stocks and bonds, a MIC is made up of carefully selected mortgages. The MIC generates income by collecting interest and fees charged to the borrowers (i.e., those who obtain the mortgage).

In addition to being an investment vehicle, a MIC operates as an actual corporation. It is comprised of professionals who manage the fund, underwrite mortgages, structure legal transactions and carry out all related administrative obligations.

Investors who deposit money into the MIC become shareholders, which means they are entitled to regular dividend payments that can be withdrawn as cash or reinvested into the fund. Under the Income Tax Act, a Mortgage Investment Corporation must pay 100% of its profits and dividends to its shareholders. As a qualified investment, a MIC can be purchased as part of an RRSP, RRIF, TFSA, RESP or RDSP.

A MIC offers investors a lower barrier to enter into the residential mortgage market. Although direct investments into private mortgages have been shown to be more lucrative than going through a MIC, investing wholesale is considerably riskier. A Mortgage Investment Corporation is set up to shield investors from the risk of private lending. A MIC is also considerably less capital intensive than financing mortgages as an individual investor.

Benefits for Investors

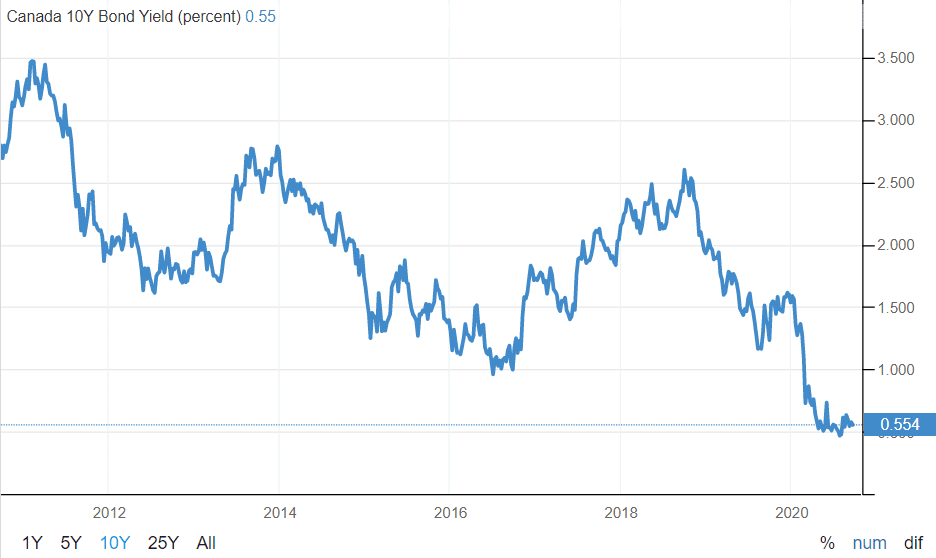

Mortgage Investment Corporations are growing in popularity because the traditional world of fixed-income securities is no longer sufficient in shielding investors from volatility. The economic and financial fallout from Covid-19 merely hastened the decline of real interest rates, which has forced investors to reevaluate their bond holdings.

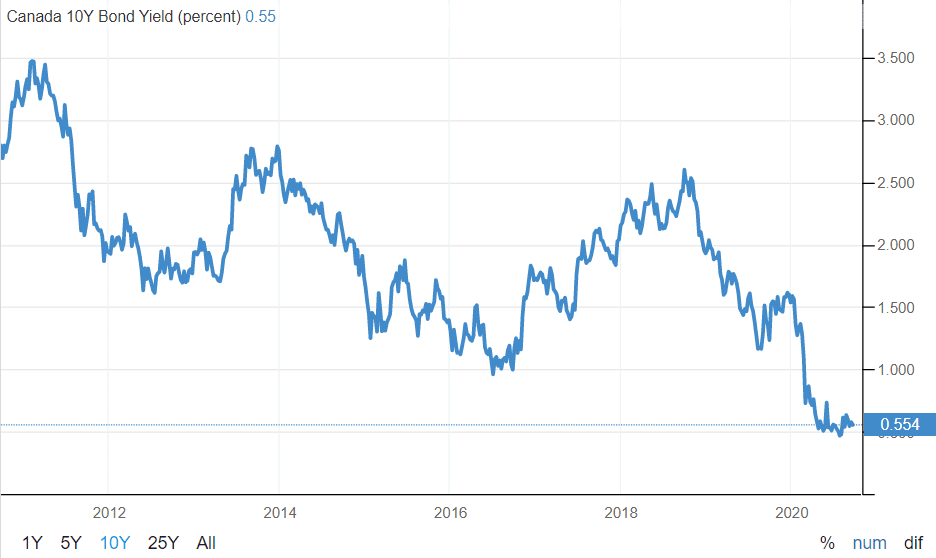

Investors are diversifying into MICs because traditional bonds offer extremely low yields. Case in point: The yield on the Canada 10-Year Government bond reached a low of 0.443% in August. As the following chart illustrates, government bond yields have been in perpetual decline since the 2008 financial crisis.

Caption: With real yields in negative territory (compared with inflation), it is no wonder investors are looking to diversify their fixed-income portfolios. | Chart: TradingEconomics

While MICs are inherently riskier than government or corporate bonds, the allure of potentially higher yields have fueled this asset’s growth. The risk is also mitigated by the fact that, regardless of the economic picture, borrowers tend to pay their mortgages, especially when they live in the home.

Because Mortgage Investment Corporations are somewhat insulated from the economic cycle, they exhibit low correlation to public markets. This means that the value of one’s MIC shares does not necessarily decline in global panic events like the March 2020 crash. An asset class that exhibits low correlation with the broader market also tends to reduce overall portfolio volatility.

Of course, mortgage investing is not for everyone. A MIC is best suited for buy-and-hold portfolio strategies that require minimal trading. MICs are therefore considered passive investments as opposed to active ones.

It is also important to note that MICs offer investors more diversity but less control over their mortgage portfolio. Wholesale mortgage investors have more control in constructing their portfolio, but once again, this comes at a higher risk. With a Mortgage Investment Corporation, investors are letting the fund do all the work. They pay higher management fees, but do not have to be involved in the legal, administrative and mortgage selection process.

Nevertheless, MICs usually have a much lower barrier to entry than wholesale mortgage investing (or other alternative investments, for that matter). In Canada, investors can buy into a MIC for as little as $5,000. Investing in wholesale mortgages requires an initial amount of $75,000 or greater.

MICs in Canada

Mortgage Investment Corporations are a multi-billion-dollar asset class in Canada. In a post-pandemic world, MICs are increasingly being viewed as an effective strategy for passive investors looking to generate income and protect their wealth. While MICs are riskier than traditional fixed-income securities, this asset class seems to have natural buffers against recession.

One of the strongest buffers is a resilient housing market. Canadian home sales surged to record highs in August, merely five months after the country first went into lockdown. With the Bank of Canada committing to lower rates for the foreseeable future, there is strong reason to believe that market conditions will remain stable for homebuyers and lenders.