Do you want to invest in the real estate market while achieving consistent and stable yields? A Mortgage Investment Corporation (MIC) is one passive investment vehicle many savvy investors add to their portfolio for an investment into the Canadian housing market without having to invest large amounts.

While the major players in the mortgage lending industry are credit unions and major financial institutions, an alternative source of mortgage lending has been consistently on the rise over the past decade—MICs.

A Mortgage Investment Corporation is an investment company created and designed for mortgage lending and provide investors with a way to tap into the real estate market while mitigating the time and risks investing in an individual mortgage entails.

It’s an excellent avenue for investment-pooling, because it enables their shareholders to invest and diversify their portfolio collectively.

A quick brief on the history of MICs

Mortgage Investment Corporations started in 1973 as part of the Residential Mortgage Financing Act. MICs saw a boost as early as 1981 when Parliament estimated that more than $5 billion is required in mortgage financing to keep pace with the rapid population growth across the country and the resulting financing needs.

Due to this projection, Parliament looked for a way to address the annually projected gap of $2.3 billion and supported MICs to increase mortgage funds to finance the construction of new homes by accessing the accumulated wealth of the small investors and pension funds.

MICs made it easier for small investors to participate in the residential and commercial real estate markets. MICs typically provide short-term loans ranging from 6 to 36 months secured by the real estate in Canada.

Understanding the regulations that govern MICs

There are various reasons as to why mortgage borrowers look into opting for MICs rather than traditional banks.

For one, MICs do not conform to the rigid and strict guidelines often imposed by financial institutions when it comes to approving loans. They also provide more flexible terms with borrowers while being able to fund loans in as little as fast as 24 hours, depending on the complexity of the loan proposal.

Borrowers thereby feel more at ease with the quick funding turnaround and the less rigid mortgage qualification guidelines. In this regard, MICs open a gateway opportunity to be able to charge interest rates that are typically above market rates.

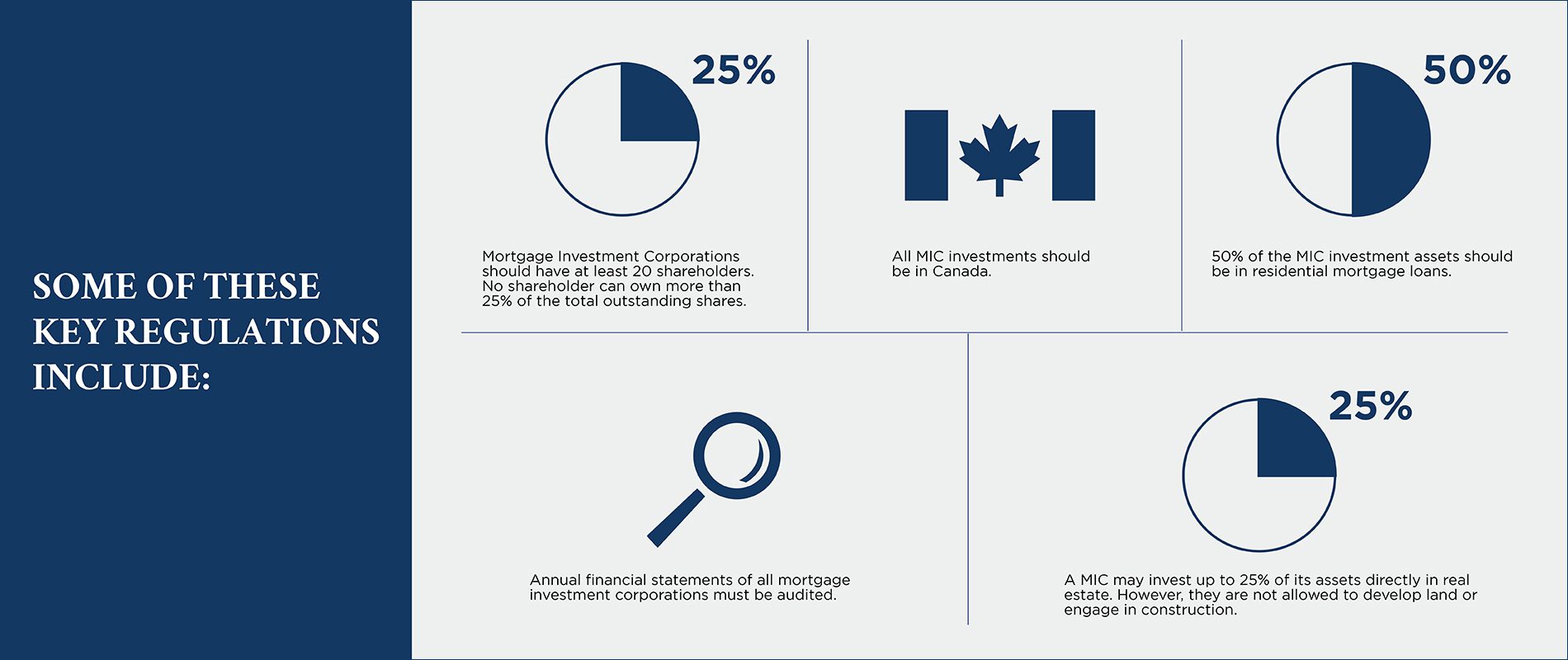

A MIC is governed by Section 130.1 of the Income Tax Act, and to maintain its status, MICs should be able to comply with several rules. Some of these key regulations include:

- Mortgage Investment Corporations should have at least 20 shareholders. No shareholder can own more than 25% of the total outstanding shares.

- All MIC investments should be in Canada.

- 50% or more of the MIC investment assets should be in residential mortgage loans.

- Annual financial statements of all mortgage investment corporations must be audited.

- A MIC may invest up to 25% of its assets directly in real estate. However, they are not allowed to develop land or engage in construction.

Some notable benefits of investing in a MIC

The allure of investing in a MIC for investors is mainly driven by the fact that it typically produces an attractive risk-adjusted yield, and is secured by real estate underlying the debt.

A MIC essentially allows the public to act as the bank with real estate at the underlying security and realizing the investment return through diversification.

Here are a few key reasons why savvy investors are currently investing in MICs:

- Putting money in a MIC can be a secure way of growing your income or capital. With this vehicle, real assets are used to secure mortgages while other assets (i.e. insurance policies and personal guarantees) are used to provide additional protection.

- Access firsthand information and knowledge from industry experts with solid background in mortgage lending. Their extensive experiences with different investment scenarios allow them to make qualified decisions that help diversify and strengthen your mortgage investment portfolio.

- When placing your funds in a broad pool of mortgages you leverage the power of diversification, resulting in managed capital risk while maximizing your returns. With the goal of growing your money, the MIC efficiently manages each mortgage plan for higher returns.

- The MIC enjoys a preferential tax treatment under the Income Tax Act of Canada with cash inflows and capital gains being tax-free. This is beneficial to shareholders because it prevents double taxation especially when a company receives interest on income.

Another notable benefit of participating in a MIC investment is the ability to utilize your RRSP funds to invest in a MIC fund directly. The income earned by your RRSP investments are tax-free.

As a result, the tax-free interest earned from a MIC held in your RRSP can compound tax-free and you don’t have to worry about paying taxes on your profits until you withdraw them from your RRSP.

Investing in a MIC

The MIC’s management is responsible for all facets of the MICs operations: sourcing of mortgage opportunities; analysis and underwriting of mortgages; structuring and facilitating the related legal transactions. The MIC then manages and administers the entire mortgage portfolio comprised of these individual mortgage investments.

Taking into consideration the risks and benefits involved, MICs are an effective alternative investment tool for Canadian investors providing consistent monthly payments derived from a pool of diversified investments.

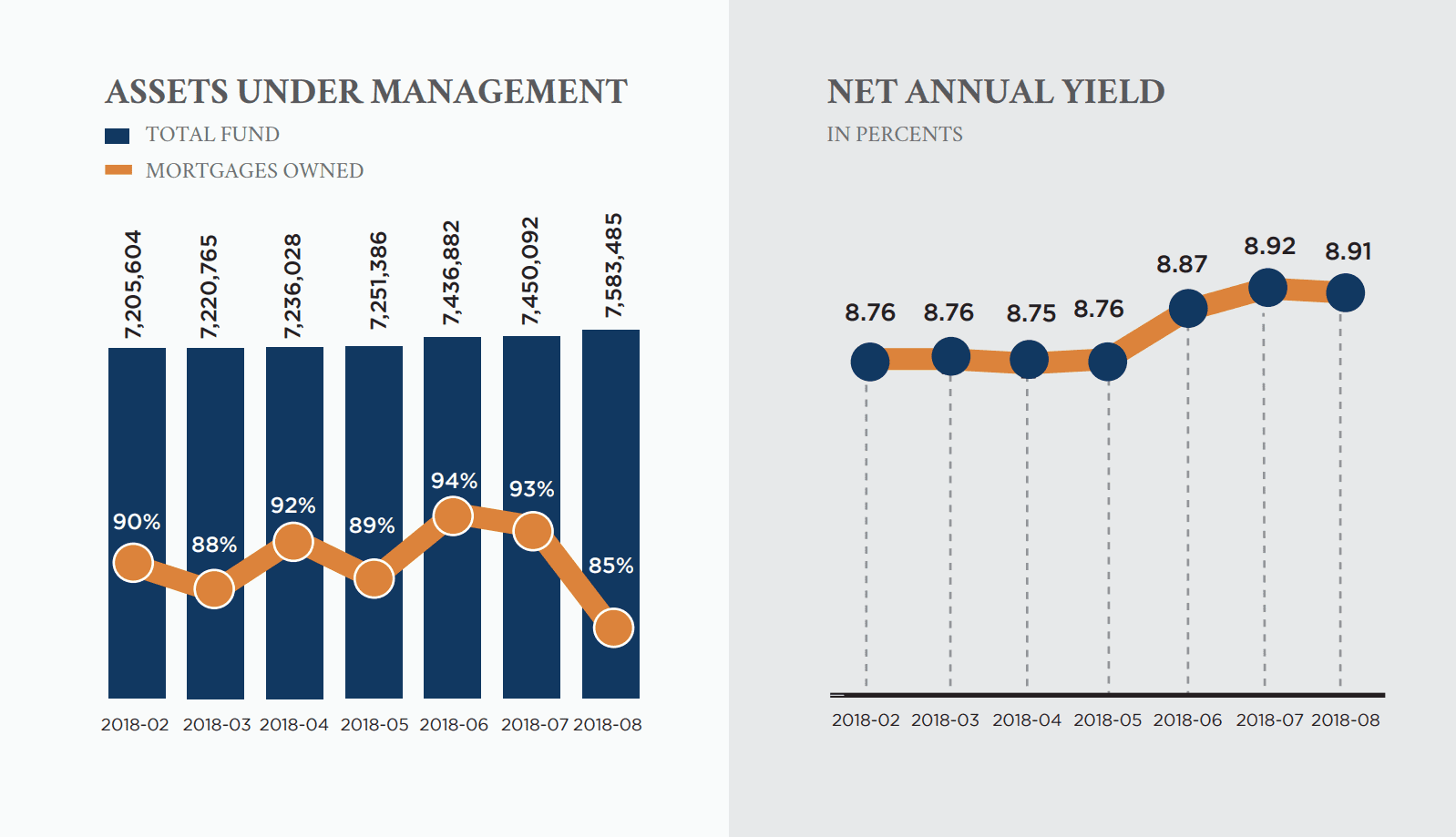

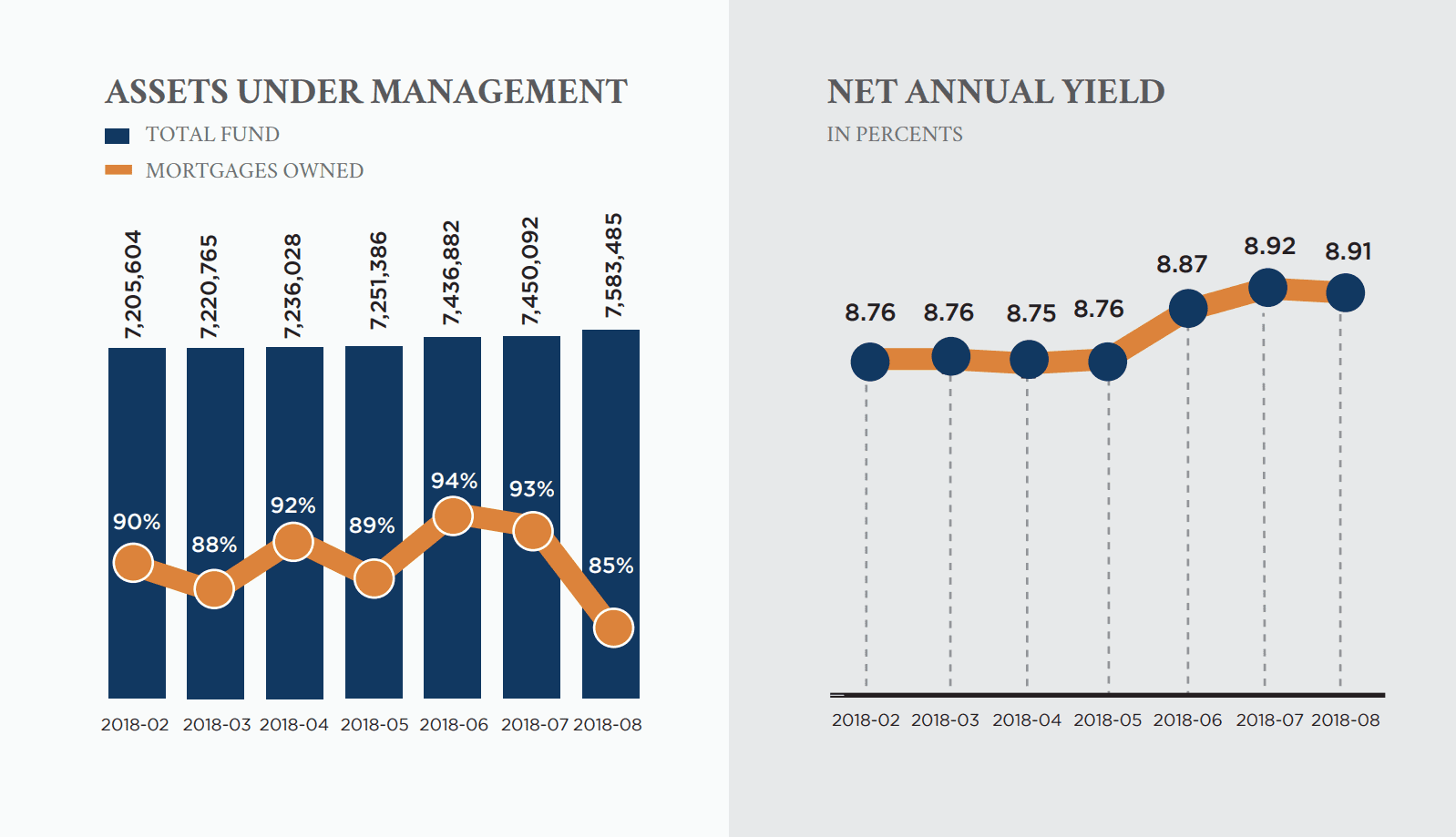

Here are the net yields the CMI MIC has provided to investors over the years.

Besides providing alternate ventures for investors, MICs also offer attractive mortgage plans for buyers who are looking for a new place to call home. Amidst the backdrop of tightening regulations and higher interest rates, borrowers are increasingly looking for alternatives, like MICs, to solve their lending problems.

Are you up for an investment-worthy venture? Contact the Canadian Mortgages Inc. today.