North America’s housing market had been running hot since the onset of the Covid-19 pandemic, as shifting labour market trends, demand for single-family properties and ultra-low interest rates fueled a generational surge in home buying. As attention now shifts to affordability, economists are debating the impact of rising interest rates on real estate demand.

2021 was a breakthrough year for residential real estate sales across North America, with home sales in Canada hitting record highs and existing home sales in the United States reaching their highest level in 15 years. However, the outlook changed considerably in 2022 as the Bank of Canada (BoC) and United States Federal Reserve implemented their most aggressive policy shift in decades.

Central bank policy impacts the housing market indirectly as banks and other lenders begin to pass on the costs of higher interest rates to borrowers. In Canada, the BoC raised rates by a full percentage point at its July policy meeting, pushing its benchmark interest rate to 2.5%. That followed three consecutive upward adjustments since March of this year. As a result, Canadian home sales have fallen for a fourth consecutive month. Although home prices have also declined in consecutive months, as of June, they remain 14.9% higher compared with last year. In the United States, existing home sales have declined for five consecutive months, with June sales down 14.2% compared with 12 months earlier.

Although demand has weakened in recent months, the limited supply of properties on the market continues to be a principal driver behind elevated home values. Home values in major urban centres have declined from their peaks, but the overall supply-demand imbalance in the market is expected to keep prices elevated in the near term. U.S. housing inventories were at 7.7 months in May 2022, a figure that reflects the monthly supply of available homes for sale to satisfy current market demand. In Canada, that figure was 3.1 months in June after falling to a low of 1.8 months in March. The long-term average is more than five months.

Central Banks Respond to Inflation

The home-buying spree that many Canadians and Americans have experienced over the past two years was stoked by record-low interest rates, as central banks mounted a coordinated response to the Covid-19 pandemic. As we mentioned at the outset, the BoC and U.S. Fed are both now aggressively raising rates to combat a generational surge in inflation and elevated levels in the CPI. Following successive rate hikes since March, both central banks are expected to continue raising rates through the end of 2022, albeit at smaller increments than the full percentage point and 75 basis-point hikes pursued by the Fed and BoC, respectively, earlier this year.

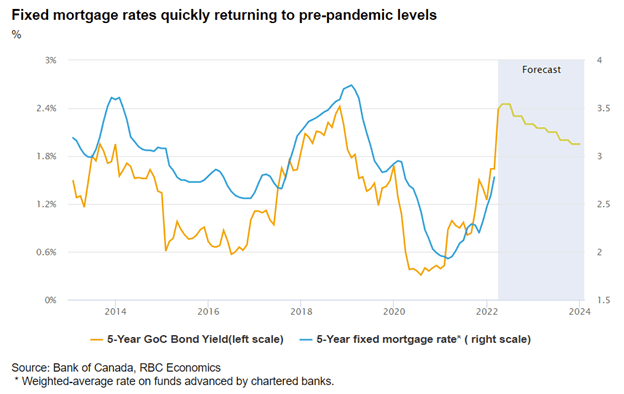

Because central-bank policy impacts mortgages indirectly, mortgage rates have already risen sharply. In Canada, fixed mortgage rates are already beyond pre-pandemic levels.

The 5-year fixed mortgage rate tracks closely with the 5-year Government of Canada bond yield. Source: RBC Economics.

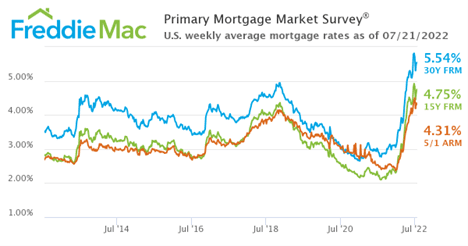

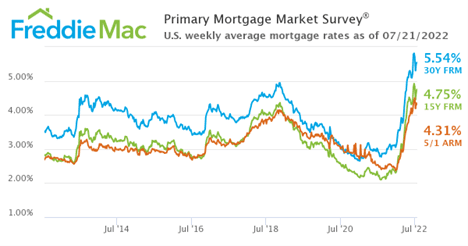

In the U.S., mortgage rates have risen to the highest level since 2009, with the benchmark 30-year fixed-rate mortgage now well above 5%.

U.S. mortgage rates are soaring as the Fed embarks on a tighter monetary regime. Source: Freddie Mac.

Economic Outlook

As inflation erodes the purchasing power of cash, consumers are negatively impacted by rising prices. While labour market conditions are improving and wages are rising, the pace of earnings growth remains far below the rate of inflation. The housing sector is also dealing with inflation in the form of rising commodity prices and increased labour costs. Steel, lumber and copper prices have risen sharply over the past year, resulting in fewer construction projects getting off the ground in the United States.

Despite these headwinds, North America’s broad economic reopening amid recent economic turmoil is expected to lead to higher consumer spending, rebounding business confidence and much-improved workforce trends. Canada’s unemployment rate has set multiple record lows this year, with the latest being the 4.9% print in June. In the United States, the unemployment rate has also returned to pre-pandemic levels. However, these figures mask declining or stagnating labour force participation rates in both countries.

Canada appears to have staved off recessionary risks, for now, with gross domestic product (GDP) expanding for 11 straight months until May, when it declined slightly. According to the Federal Reserve Bank of Atlanta, the United States appears to be already in recession, which is described as back-to-back quarters of negative GDP growth.

As traditional lending markets continue to tighten, Mortgage Investment Corporations (MICs) are in a prime position to meet the unique financing needs of Canada’s mortgage market. CMI has been providing mortgage investment services for more than 15 years. To learn more about our industry-leading CMI MIC Funds, contact an investment manager for a free consultation.

Contact us by filling out the form below for more information about our MIC funds and opportunities.