In 1952, economist Harry Markowitz introduced Modern Portfolio Theory (MPT) in an essay for which he won a Nobel Prize in Economics. This model has served as a cornerstone for modern finance and has inspired both praise and criticism.

MPT’s premise rests on the assumption that investors are risk-averse. The model is a mathematical framework that aims to optimize returns for a given level of risk by managing asset diversification.

As opposed to assessing investments individually, MPT looks at the productivity of an entire portfolio and how a combination of assets interact in ways that affect a portfolio’s overall risk and return. In practice, scrupulous financial advisors treat MPT as one of several guiding principles when designing portfolios and allocating assets for clients, rather than a strict rule by which to abide by.

Prior to Markowitz’s pioneering model, investment opportunities were evaluated independently and weighed against others to see if they were “winners.” Winners were investments that provided acceptable returns without too much risk; the metrics for this approach were largely subjective in nature. With MPT, investment success was less about simply finding promising investments and more about finding the best combination of assets.

MPT uses several concepts to assess a portfolio’s efficiency and optimization — standard deviation, correlation, and the efficient frontier.

Standard Deviation

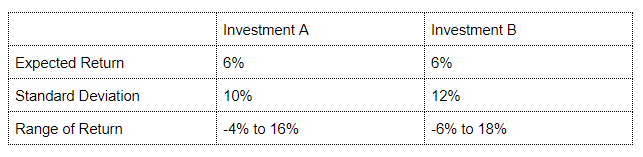

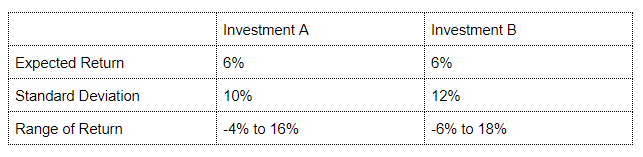

Standard deviation, in the context of finance, measures the volatility of an investment by illustrating how much it deviates from its average or expected return. For example, if an asset is expected to appreciate in value by 6% and it has a standard deviation of 10%, the range of its return will be between -4% (a loss) and 16% (a gain).

Hence, the bigger the standard deviation, the wider the variance between expected and actual return. In other words, greater standard deviations translate into higher investment volatility.

In the context of Modern Portfolio Theory, volatility is virtually synonymous with risk. The standard deviation is considered an essential element in the evaluation of an investment’s risk-to-return profile. Given two opportunities with the same return, differing standard deviations may tip the scales favouring the one with the lower value.

In this scenario, Investment A has a lower standard deviation, suggesting that it carries less risk than Investment B. However, A also has a lower maximum yield, so depending on an investor’s willingness to accept a bigger risk premium for better returns, B may be the better option for a given investor.

Correlation

However, the story doesn’t end at assessing the levels of risk. According to Modern Portfolio Theory, the combination of assets and how they fluctuate in relation to each other is ultimately what makes up an optimized portfolio.

Among asset classes, some investments have a positive correlation, meaning they rise and fall together whereas others move in the opposite direction – when one climbs, the other falls. And yet, other assets are unrelated, fluctuating independently from one another.

Correlation is expressed as numbers between +1 and -1, where assets that have a +1 relationship are perfectly correlated and move up and down together, and assets that have a -1 correlation rise and fall inversely. When two assets are not at all affected by each other, they have a correlation value of 0.

For example, mortgage rates and house prices are typically inversely correlated. Consumers are incented to borrow when interest rates are low, which in turn increases the demand for real estate, resulting in an increase in housing prices.

Under the MPT model, the most optimal portfolio is composed of assets that are not correlated with one another. Anyone designing a portfolio of investments should try to get as close to a zero correlation value as possible. The more independently an asset moves, the less impact its inherent risk will have on the rest of the portfolio. This is the basic premise of diversification, a term familiar to most investors.

Correlation is an important factor for investment vehicles like Mortgage Investment Corporations (MICs), which provide an alternative way to gain exposure to real estate. MICs capitalize on the strengths inherent with mortgages, the principles of which don’t change regardless of what happens to housing prices, interest rates or the market as a whole. Thus, a MIC is an excellent example of an asset class that can hedge the risks inherent with other investment options.

The Efficient Frontier

Modern Portfolio Theory’s primary objective is the realization of what is called “the efficient frontier,” which is essentially the most optimal combination of assets- one that achieves the maximum return at the lowest possible risk.

As a visual representation, the efficient frontier illustrates and evaluates portfolios based on their risk and return profile, where standard deviation is usually the value representing risk and compound annual growth rate (CAGR) is often used as the return component.

The efficient frontier gives investors a framework for asset selection. Given two options that have the same rates of return, the more “efficient” choice would be the one with lower risk.

Between direct and indirect real estate investments, the latter generally ranks lower for risk because it is less capital intensive and has a lower correlation to market fluctuations. Additionally, privately held firms like CMI’s MIC have the flexibility to react to economic and regulatory changes, which are both contributors to risk.

Impact

Despite its prevalence in investment strategy, critics question MPT’s validity and relevance in the context of real-world phenomena. Critics of the model argue that several of MPT’s underlying assumptions do not reflect actual trends and scenarios in the markets.

For example, MPT uses an average expected return as a baseline of computation when, in fact, extremely high and extremely low returns are more likely in the market. Another contestable assumption MPT makes is that volatility is synonymous with risk, when in actuality, risk determination varies on a case-by-case basis.

Perhaps a more significant criticism is that MPT assumes that investors are always rational. In reality, investors are human beings that are susceptible to emotions like fear and greed. David Stein, investment advisor and host of the YouTube channel Money for the Rest of Us, claims that, in his experience, clients are less interested in optimizing their portfolios and more interested in finding investments that are appropriate for their comfort level.

This highlights the significance of working with investment advisors and firms that take into account an investor’s profile in order to ascertain clear investment objectives for their clients.

Whatever strategy or model one subscribes to, Modern Portfolio Theory provides a starting point from which investors and advisors can begin the balancing act of the investment selection and portfolio creation process. The model’s basic principle still stands: not putting all of one’s eggs in one basket is a wise investment strategy. Of course, it’s also critical that one choose the right eggs in the first place.