When investing in financial markets, it’s important to consider risk tolerance in your asset selection. Risk tolerance is the amount of volatility in the value of an investment you’re willing to endure – and the degree of loss you’re willing to accept – as part of your investment strategy. How much risk you tolerate depends mainly on your investment goals and time horizon. Naturally, risk tolerance tends to fluctuate with age and changing life circumstances. If your primary goal is to not lose money and maintain the inflation-adjusted purchasing power of your assets, a capital preservation strategy is probably for you.

What Is Capital Preservation?

Investing for capital preservation is a strategy designed to preserve your money and the overall purchasing power of your assets. As an investment principle, capital preservation involves investing in the safest and least volatile short-term assets, such as Government of Canada bonds and Guaranteed Investment Certificates (GICs), rather than stocks, equity mutual funds or exchange-traded funds (ETFs). Capital preservation is designed to be defensive, which means you will likely be investing in low-growth assets that are protected as opposed to stocks that fluctuate with the business cycle.

Investors opt for a capital preservation strategy if they are risk averse, have a short investment horizon, and/or want to generate predictable income from their portfolios. Retirees and investors nearing retirement often rely on capital preservation strategies because they have limited time to recoup losses if the market experiences a downturn. Safety takes priority over capital appreciation for these investors, especially in the short term.

Advantages of Capital Preservation

The primary advantage of capital preservation is safety. By investing in low-risk assets such as short-term government bonds, GICs and mortgages, investors can shield their portfolios from market volatility. Although capital preservation often generates much lower returns than a growth portfolio, you’re far less likely to lose money. Some investment vehicles used by investors with a capital preservation mindset are insured by the Canada Deposit Insurance Corporation (CDIC) for up to $100,000 on eligible deposits.

A capital preservation mindset is also advantageous during extreme market volatility, political instability or recession. 2022 was an unusual year for global stock markets, with benchmarks like the S&P 500 Index falling 19.4% and the S&P/TSX Composite Index declining 8.5%. While ultra-defensive investors don’t usually react to short-term fluctuations in the market, the extraordinary actions of central banks to combat inflation have led many investors to reevaluate their risk tolerance and adopt a more risk-off approach, even if it’s only temporary.

Disadvantages of Capital Preservation

The primary disadvantage of a capital preservation strategy is it typically generates much lower rates of return than a growth investment strategy. When you eliminate risk from your portfolio, your asset selection dramatically diminishes. For the ultra-defensive investor, often all that’s left is government bonds, GICs and cash held in low interest-bearing accounts. These assets are “safe,” but what happens when they can’t keep up with inflation? In real terms, these “safe” assets lose value in this scenario.

Although bond yields have risen since 2021, so has inflation. With cost pressures at multi-decade highs and expected to remain elevated for the foreseeable future, defensive investors must come to terms with the possibility of zero – or even negative – real returns.

Mortgage Investment Corporations (MICs) Can Improve Your Capital Preservation Strategy

Capital preservation strategies prioritize safety over growth, but that doesn’t mean they should neglect to provide any positive returns. At the very least, defensive investors should be able to preserve the inflation-adjusted purchasing power of their assets and income. Mortgage Investment Corporations, or MICs, are defensive cash flow investments that are similar to other fixed-income assets but have a proven track record of providing much higher rates of return.

In Canada, MICs are pooled investment funds that invest in private mortgages on behalf of investors. Regulated and governed by the Income Tax Act, a MIC operates like a mutual fund or exchange-traded fund, but instead of holding stocks and fixed-income securities, it is comprised of carefully selected mortgages that produce income by collecting fees and interest from mortgage borrowers. A MIC investor is a shareholder of the fund, which entitles them to regular dividend payments. In Canada, a MIC can be included in several tax-advantaged accounts, including a TFSA, RRSP, RRIF and RESP.

Investing in a MIC provides investors with direct exposure to Canada’s residential real estate market, but without the risk of homeownership or title transfer. Canada exhibits ultra-low mortgage delinquency rates – a strong track record maintained during the Covid-19 pandemic and with the Bank of Canada hiking interest rates. At the start of 2023, the national mortgage delinquency rate was at a historic low of 0.14%. Although private mortgage portfolios have a slightly higher delinquency rate of roughly 1% to 2%, this doesn’t necessarily mean a direct loss for the investor. MICs that employ proper risk management and portfolio diversification can significantly reduce the impact of delinquency on investors’ returns.

It’s important to note that a delinquency does not mean a loss for the investor. MICs are actively managed and each fund provider’s comprehensive risk management protocols include a robust process to manage and recoup any missed or NSF (non-sufficient funds) payments. (Mortgage default is more serious and occurs after multiple missed payments.) In addition to proactive, professional management, risk is further reduced through diversification. By allocating investor capital across a diversified pool of mortgages, risk is mitigated by spreading it over multiple mortgage assets.

Mortgage Investing with CMI MIC Funds

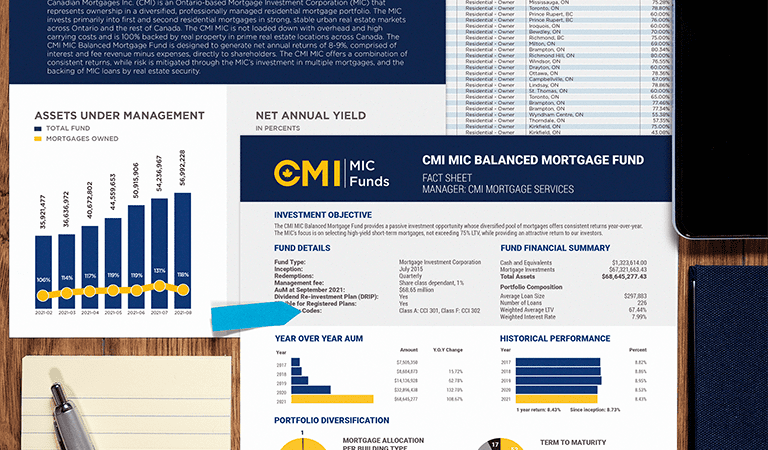

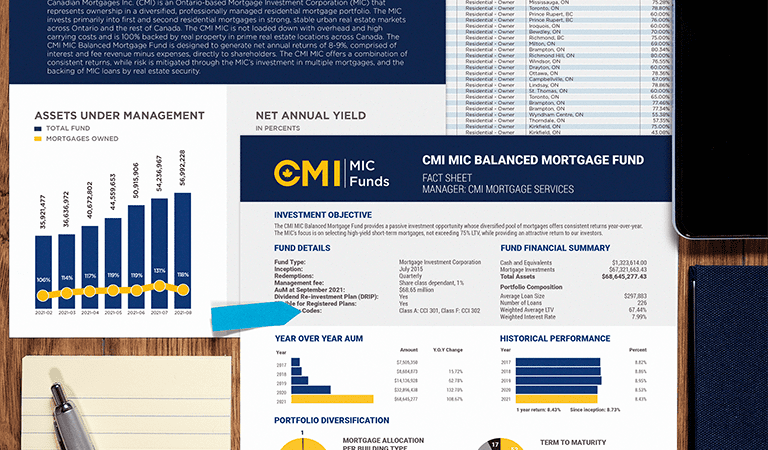

CMI MIC Funds are accessible and transparent mortgage investment portfolios suited for defensive-minded investors. For the conservative, the CMI MIC Prime Mortgage Fund invests in a risk-mitigated portfolio of mortgages targeting an annual return of 6% to 7%. The Fund invests primarily in first mortgages with an average loan-to-value (LTV) ratio of less than 65%. Investors with a slightly higher risk profile may be suited to the CMI MIC Balanced Mortgage Fund, which invests in both first and second mortgages with an average loan-to-value that does not exceed 75%, and targets annual returns of 8% to 9%. The CMI MIC High Yield Opportunity Mortgage Fund targets returns of between 10% and 11% by investing in mostly second mortgages with a maximum average loan-to-value of 85% .

Regardless of the individual risk profile, CMI MIC Funds employ a rigorous due diligence process for selecting and managing mortgages. Our adjudication process carefully evaluates and verifies each mortgage application for income, assets, debt, and repayment history. CMI MIC Funds also appraises each individual property and evaluates the potential risk exposure to investors. All mortgage loans are managed through an automated software solution and reassessed at maturity. This includes providing borrowers with an exit strategy that allows them to improve their financial situation and move from the private space back to an A Lender at the end of their loan term. The exit strategy is part of the underwriting process and will depend on the borrower’s circumstances. The exit strategy outlines how the borrower will exit this loan at maturity. For example, it may be to improve their credit and move to an A Lender.

Diversify your Portfolio with CMI MIC Funds

CMI MIC Funds is administered by CMI Financial Group, one of Canada’s fastest-growing non-bank financial institutions. With over $1.8 billion in mortgage placements, CMI Financial Group is the industry leader in delivering high-performing mortgage portfolios. Our professionals have over 100 years of combined experience in the mortgage industry. Together, they have raised the bar in mortgage adjudication, selection and risk management – with demonstrated results.

To learn more about how CMI MIC Funds can deliver you peace of mind and sound returns, contact one of our Investment Professionals for a free consultation.