Canada’s red-hot housing market continued to moderate in May, as tighter inventories and higher valuations contributed to a broad decline in home sales. However, sales and price levels remain historically high, reflecting pent-up demand for residential property that has continued to build throughout the pandemic.

Home Sales Moderate but Activity Remains High

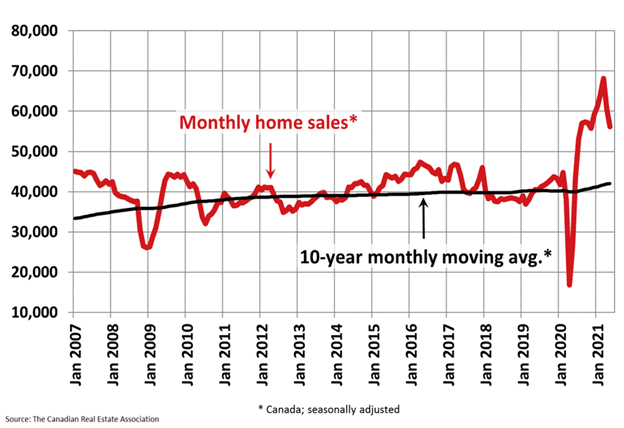

On a monthly basis, home sales fell by 7.4% in May, with nearly 80% of all local markets registering declines, according to the Canadian Real Estate Association (CREA). The number of newly listed properties fell by 6.4% during the month. Nevertheless, activity remains at historically elevated levels, with transactions rising 103.6% year-over-year.

Despite the recent pullback, home sales are running closer to levels seen in the second half of 2020. | Source: CREA.

As CREA noted, the declines in May weren’t caused by structural changes in the housing market, but by “fatigue and frustration among buyers,” namely:

“More and more, there is anecdotal evidence of offer fatigue and frustration among buyers, and the urgency to lock down a place to ride out COVID would also be expected to fade at this point given where we are with the pandemic.”

Housing prices also edged up in May, climbing 1%. Compared with May 2020, home values have surged by 38.4%.

Job Market Loses Steam During Lockdown

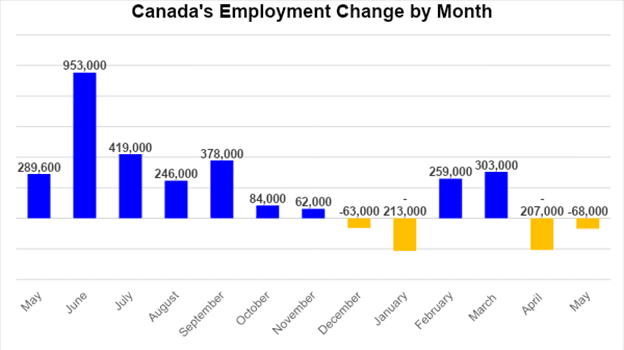

Overall employment declined by 68,000 in May, marking the second straight month of sharp declines in the wake of more stringent lockdowns in Ontario and other provinces. Goods-producing industries were especially hard hit, with manufacturing employment falling by 36,000. Retail stores also furloughed 29,000 workers during the month. As a result, the national unemployment rate edged up to 8.2% from 8.1% in April.

Canada’s labour market suffers a second consecutive month of declining employment. | Data source: Statistics Canada.

Despite the pullback, analysts are calling for a brisk rebound once COVID-19 restrictions are gradually lifted. As Canada continues to make progress on the vaccination front, more workers should return to work in the coming months.

Home Prices Haven’t Peaked Yet: RBC

Homebuyers who are waiting for property values to peak before entering the market may have to wait a while longer, according to Robert Hogue of RBC Economics. “Home prices haven’t peaked yet in Canada,” reads his latest market update released on June 15.

“It increasingly looks like March’s stratospheric activity level will be the cyclical peak in Canada,” he said while pointing to tighter demand-supply constraints. The sales-to-new listings ratio in Canada fell for a fourth consecutive month in May, indicating that sellers are firmly in control of the market. The rise in property values was most acute in British Columbia and Ontario, with the Greater Toronto Area witnessing an annual increase of over 40%.

TSX Cracks 20,000

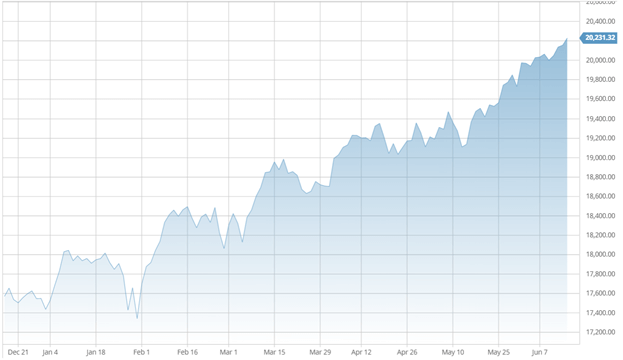

Toronto’s benchmark TSX Composite Index topped 20,000 in early June for the first time on record, sending a strong signal that the bull market had regained momentum. Surging oil prices and a multi-year high for the Canadian dollar were positive tailwinds for equity prices in this country.

The TSX Composite Index maintains its bullish stance in June. | Source: Barchart.com.

In the United States, the S&P 500 Index and Nasdaq Composite Index also touched new peaks in June amid growing optimism that the post-COVID-19 recovery is still on track.

Conclusion and Summary

Canada’s economic reopening is gaining traction as the national vaccine rollout continues. A continuation of this trend likely bodes well for the economy and the housing market.

What Happens Next?

CMI Financial Group will continue to analyze market, financial and economic changes and keep you updated on a regular basis. To learn more about CMI’s private mortgage investment program, contact us below.