A mortgage is a legal agreement between a mortgage lender and mortgage borrower, where the former lends money to the latter at flexible terms. It has a cost determined using current industry rates. According to the Financial Consumer Agency of Canada, your mortgage payments will first cover for the loan’s interest as well as taxes and insurance. Gradually, as the agreement matures, more of your payment goes to the principal amount of the loan until it is paid in full. By then, the mortgage becomes void at zero outstanding balance, and you will gain ownership of all the equity in your property which you have paid for through your down payment and your mortgage payments.

For instance, you’ve found your dream home. Congrats! You agreed to a price of $400,000, and are putting down the standard 5%. You mortgage then will need to be $400,000, minus the 5%, for a total of $380,000. However, you will need to pay back this amount you borrowed and with interest.

Know Your Mortgage Terminology

Purchasing a new home is a huge decision to make, and before you take this significant leap in your life, you need to be informed of your options. However, exploring your mortgage options before you make any important decision may seem overwhelming at first because of all the technical terms that you may not be so familiar with. But with some preparation and study, these little anxieties are guaranteed to fade away. To guide you, below are several mortgage terms and definitions that you need to learn so that you’ll be better equipped to find the most suitable mortgage for you.

Mortgage: A large loan you get to purchase a property. If you are unable to pay the loan on time, the mortgage agreement empowers the lender to take ownership of the property you bought.

Mortgagor: The borrower in a mortgage agreement.

Mortgagee: The lender in a mortgage agreement.

Downpayment: The money that you are ready to pay up front but is only a percentage of the total price of the property. You will need a mortgage loan to cover the remaining amount.

High-Ratio Mortgage: The amount borrowed through a mortgage is 80% of property’s price or appraised value. In this type of mortgage, insurance must be secured to protect the lender in the event that the borrower defaults on the loan.

Pre-Approved Mortgage: In getting pre-approved for a mortgage, the potential home buyer is already qualified to secure a certain loan amount even before he or she starts house hunting.

Amortization Period: The total number of years it takes for a borrower to fully pay off a mortgage loan.

Mortgage Term: The length of time that you’re legally committed to a particular mortgage agreement. The duration that a mortgage has legal effect ranges between 6 months and 10 years. Once this term is up, the loan is either completely paid off, or the mortgage is renewed with new terms to continue paying for the remaining amount.

Open Mortgage: The borrower is allowed to make prepayments or extra payments during the term of the mortgage. However, this is usually applicable only in short-term mortgages that last from six months to one year, and the interest rate is typically higher.

Closed Mortgage: The borrower is usually required to pay off the loan for a defined period of time at a specified mortgage rate. If extra payments beyond the parameters of the mortgage agreements are made, then the borrower may be required to pay penalties.

Interest Rate: The percentage of the loan amount that a borrower must also pay to the lender aside from the principal loan amount in exchange for using the lender’s money to buy a property.

Fixed Interest Rate: The mortgage agreement has provided for a fixed rate of interest that applies for the entire duration of the mortgage term. The amount of the borrower’s payments throughout the agreed term is fixed as well.

Variable Interest Rate: The borrower’s mortgage payments are dependent on the changes in interest rates. If the interest rates increase, the borrower’s payments increase as well.

CMHC: Stands for the Canada Mortgage and Housing Corporation, a Crown corporation which serves as the Canadian government’s primary authority on the housing industry.

Specify Your Needs

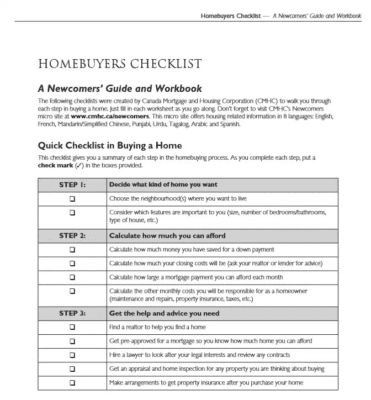

What do you need the mortgage for? How much can you afford? How long are you willing to pay the amortization? Borrowers need to specify these details before deciding to get a mortgage. The simple checklist below will guide you in making the right decision of getting a mortgage.

Home Details

Where do you want to live? What type of home do you need? Is it a new house or pre-owned? Always be specific about what you want. Not only that, always consider security and accessibility to retail, schools, shopping, and transit as well.

Preparedness

Be ready as you will be tied up to a significant financial obligation. Check your cash flows and budget. In creating your budget, factor in items such as the monthly payments, insurance, maintenance fees, property taxes, and other expenses.

Recommendations

Get help from mortgage experts and professionals who can show you the best housing options in the market.

Identify the Source of Mortgage

The two primary sources of mortgage in Canada are directly through mortgage lenders or a mortgage broker. Each of these options differs in various ways. Let’s look at specific details for each one:

Mortgage Lenders

Lenders are individuals, private institutions, and groups of investors who gather funds and lend money directly to borrowers. Lenders such as private banks, insurance companies, and credit unions may offer different rates from one another.

Mortgage Brokers

Licensed brokers are middlemen between lenders and borrowers handling the mortgage approval transactions. They have an extensive network of lenders that allow them to match your requirements to the right lender. In Canada, Brokers are members of the Mortgage Professional Canada.

The Pre-Approval Process

The pre-approval process is a systematic approach where the lender or broker checks the capacity of the borrower for a mortgage. This procedure can determine the initial amount a loanee will receive, and the interest rate you’ll pay.

How will you Qualify for the Mortgage?

The result of the pre-approval process will determine if you qualify. As a borrower, you need to convince the lender or broker that you can afford by providing them with the following details:

- Credit Report

- Proof of Income

- Asset Declaration

- Employment Records

- Proof of Billing Address

- Social Security Membership

- Valid Identification

- Other Documentation

Before approving the mortgage, lenders or borrowers will assess your ability to pay the loan. They do this by calculating your Gross Debt Service (GDS) and your Total Debt Service (TDS) ratios. GDS ratio is the percentage of your income that will be used to pay off all housing-related costs per month. This includes your mortgage payments, property taxes, heating costs, and if applicable, 50% of your condo fees.

Your TDS ratio, on the other hand, is the percentage of your income that will be used to pay off not only your housing costs (GDS) but also your other obligations every month. This may include monthly credit card and car payments. According to CMHC, the GDS ratio and the total debt load of a borrower (TDS ratio) must not exceed 32% and 40% of the borrower’s gross income, respectively.

For example, if your gross income is $60,000, and you expect that you’ll be paying $500 in property taxes and heating costs and $400 for your car payment every month, then the maximum monthly mortgage payment you can afford is $1,100. Your housing costs of $1600 a month and a total debt load of $2000 every month will not exceed 32% and 40% of your gross income, respectively.

Getting a Mortgage in Canada

Since not everyone can afford a property outright, mortgages help Canadians by enabling them to live in a home they own. When you sign in for the mortgage, you agree to a legal agreement that includes financial obligations. With this, it is essential to consider every element of the loan process before making a decision. By now, you have a better understanding of what’s in store for you when you walk into your bank or speak with your trusted mortgage broker.

If you are not sure what to do, the mortgage experts from Canadian Mortgages, Inc. will guide you throughout the entire mortgage application process.